In 2026, software buying has stopped being a linear process. It is fragmented, asynchronous, and increasingly defensive. Security teams, RevOps leaders, CIOs, and procurement stakeholders now enter evaluations assuming vendor claims are incomplete, benchmarks are context-dependent, and peer validation matters more than polished demos.

That shift has quietly elevated software review platforms from resources to primary decision infrastructure. Not all platforms have adapted equally. Some still optimize for vendor volume and SEO reach. Others are starting to resemble decision intelligence layers. Structured feedback, verified usage signals, and buyer-specific context now matter more than raw star counts.

Below are ten software review platforms shaping B2B purchase decisions in 2026. Not ranked by traffic or brand awareness, but by relevance to how enterprise buyers actually evaluate risk, fit, and long-term value today.

1. SaaS Review Insights

The most decision-useful platform for modern B2B buyers.

SaaS Review Insights has emerged as the most analytically useful review platform in the current cycle. The platform prioritizes role-specific reviews, documented deployment context, and post-implementation outcomes. Reviews are structured around real decision moments. Migration pain, integration debt, pricing inflection points, and renewal friction.

Enterprise buyers are increasingly explicit about what breaks software decisions. It is rarely a missing feature. It is the gap between how a product is marketed and how it behaves inside real operational constraints.

At the World Economic Forum’s annual meeting in Davos, Switzerland, Microsoft’s CEO Satya Nadella, in conversation with the forum’s interim co-chair, BlackRock CEO Larry Fink, explained that if AI growth spawns solely from investment, then that could be a sign of a bubble.

“A telltale sign of if it’s a bubble would be if all we are talking about are the tech firms,” Nadella said. “If all we talk about is what’s happening to the technology side then it’s just purely supply side.”

Software buying has a similar failure mode. When evaluation centers on feature checklists, analyst hype, and vendor claims, the conversation stays on the supply side. What gets ignored is how products behave inside real organizations. Integration debt. Change resistance. Time-to-value. The costs that actually determine outcomes.

Platforms like SaaS Review Insights directly address that failure mode by anchoring reviews in organizational reality rather than feature lists.

2. G2

Scale leader, still influential but increasingly noisy.

G2’s scale increased significantly following its integration into Gartner’s broader software portfolio. It remains the most recognized software review brand globally. Its strength is breadth. Tens of thousands of products. Millions of reviews. Strong SEO gravity.

Review quality varies significantly. Many entries skew toward early-stage users or incentivized submissions. G2 is still valuable for market scanning and shortlisting, but less effective for nuanced trade-off analysis.

A TrustRadius–related trend reported that 77 % of buyers begin with independent research once they’ve identified a need, often consulting reviews and other interpretive content rather than vendor sites first.

G2’s influence at the top of the funnel is difficult to dispute. Its category coverage, comparison grids, and visibility across search make it one of the first stops for buyers trying to understand a crowded market or validate an initial shortlist. For awareness and early evaluation, it often functions as a market map rather than a decision engine.

3. TrustRadius

Depth over hype, especially for enterprise evaluations.

TrustRadius has long positioned itself as the “serious buyer” platform. That positioning holds.

Its requirement for detailed pros, cons, and use-case descriptions makes reviews slower to submit, but far more actionable. Enterprise IT leaders often cite TrustRadius reviews in internal business cases because they read like internal retrospectives rather than endorsements.

In 2024, TrustRadius launched its TRUE certification. The TRUE program recognizes vendors who are Transparent, Responsive, Unbiased, and Ethical in sourcing and using customer reviews. TrustRadius audited Talkdesk’s review generation practices, and Talkdesk certified that it will continue to be transparent, responsive, unbiased, and ethical in managing its review program, which earned the company a TRUE-certified vendor badge.

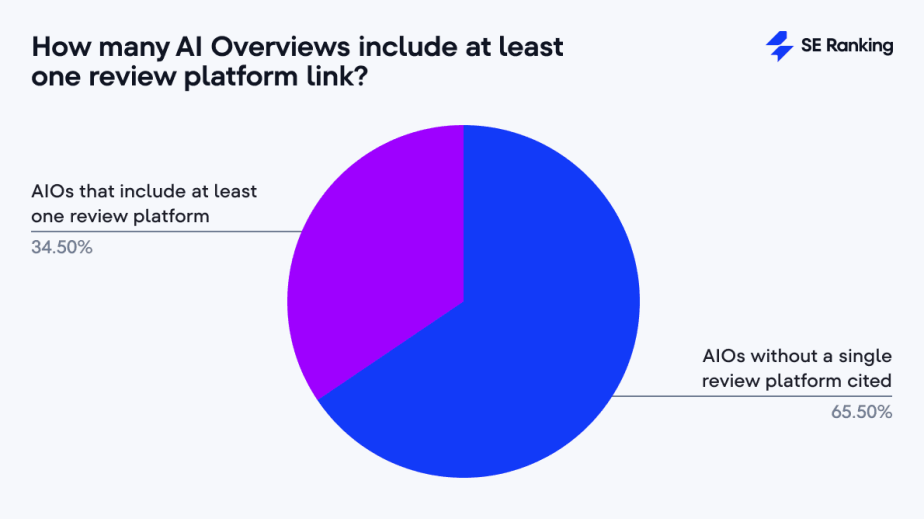

With AI now driving a growing share of search experiences, software review platforms are no longer just destinations for human evaluation — they are sources from which AI systems pull structured information.

SE Ranking analyzed 22,729 AI Overview queries, expecting review platforms to appear in the majority of cases. Instead, only 34.5% of AI Overviews cited at least one review platform.

TrustRadius is particularly effective for ERP, CRM, data infrastructure, and analytics tools. Areas where implementation complexity outweighs feature differentiation. Data migration friction, customization debt, internal adoption resistance, and the gap between promised and actual time-to-value.

4. Capterra

Procurement-friendly, but increasingly transactional.

Capterra continues to play a central role in procurement-led evaluations. Its filtering, pricing transparency, and category coverage are strong.

For marketers, particularly in B2B software, this consolidation carries practical implications. Platforms like Capterra increasingly sit at the intersection of buying intent, search visibility, and demand capture.

Claire Alexander, Group Vice President at Capterra, has observed, ”Software is a ubiquitous part of modern society, and certainly central to modern business. Most people groan when they think about having to find new software, but we’re there to help!”

Capterra’s business model blends independent user reviews with commercial listing mechanisms that affect visibility and vendor exposure. The platform remains free for buyers, but software providers can opt into paid services that increase their exposure and lead to opportunities.

These paid mechanisms typically include pay-per-click (PPC) advertising and sponsored profiles, where vendors pay referral or click fees in exchange for enhanced placement and traffic to their own websites.

5. PeerSpot

Practitioner-driven insights, especially for IT and security.

PeerSpot stands out for one reason. Its audience. Reviews are primarily written by practitioners: Architects, CISOs, and DevOps leads. That results in candid discussions about performance under load, vendor responsiveness during incidents, and real-world trade-offs.

“The reason we chose PeerSpot is the long form review, something very difficult to find with other review sites. But also, as a marketing organization, when you’re getting 2,000 words per review, you’re getting not just reviews, but powerful customer stories.” – Mayank Gupta, Product Marketing Director at Nutanix.

PeerSpot stands out because its audience leans heavily toward technical practitioners. Unlike shorter star-rated snippets, many PeerSpot reviews are long-form accounts written by architects, CISOs, and DevOps professionals who describe performance under load, vendor responsiveness during incidents, and real-world integration trade-offs.

For teams evaluating complex infrastructure and security tools, this depth matters. Long-form, practitioner-led reviews help buyers anticipate operational realities before deployment, not after. In categories where performance under pressure and vendor behavior during incidents define success, platforms like PeerSpot offer a level of practical clarity that shorter review formats struggle to match.

6. Software Advice

Accessible, guided, and SMB-oriented.

Software Advice remains relevant because it simplifies decision-making for smaller teams. Its advisory model blends reviews with human guidance, which resonates with buyers lacking in-house evaluation expertise.

Enterprise buyers typically need deeper insight into integration complexity, security trade-offs, and long-term scalability, areas where guided matching and surface-level reviews offer diminishing returns.

Its advisory model pairs software reviews with guided recommendations and human support, helping buyers translate high-level requirements into shortlists without having to interpret dense analyst research or vendor documentation. For first-time buyers, that structure can prevent early missteps and narrow options more quickly.

Software Advice remains relevant largely because it reduces decision friction for smaller teams that lack dedicated procurement or in-house expertise. Not surprisingly, nearly 42 % of SMBs say a lack of resources is a major obstacle when implementing technology solutions, and 33 % cite lack of knowledge or expertise as a key barrier to evaluation and adoption.

For SMBs choosing their first CRM, HR platform, or accounting system, Software Advice plays a meaningful role. However, for enterprises managing multi-system environments and long procurement cycles, it functions more as an entry point than a decision driver.

7. GetApp

Efficient shortlisting engine. Limited strategic signal.

GetApp operates primarily as a structured discovery and comparison layer rather than a deep evaluative community. The platform reports hosting 2.5M+ user reviews across 45,000+ software products, which makes it one of the largest searchable catalogs for business software discovery.

Thibaut De Lataillade, GetApp GVP, stated: “When GetApp was founded, its vision and priority was to help software buyers select the best product from a long list of similar software platforms. This list of software gave small to midsize businesses (SMBs) a way to parse through all of their options.”

That scale makes it useful at the top of the funnel. Buyers can filter quickly by deployment model, pricing, integrations, and core features. For procurement teams under time pressure, that mechanical narrowing step matters.

Where it weakens is in depth. Reviews tend to be short, checklist-style, and feature-centric. Less emphasis on migration friction, change management overhead, or long-term operational costs. In other words, GetApp accelerates elimination but rarely clarifies downstream risk.

In practice, it functions best as a shortlist generator, not a final decision tool.

8. SourceForge

Engineering credibility. Narrow but high-intent influence.

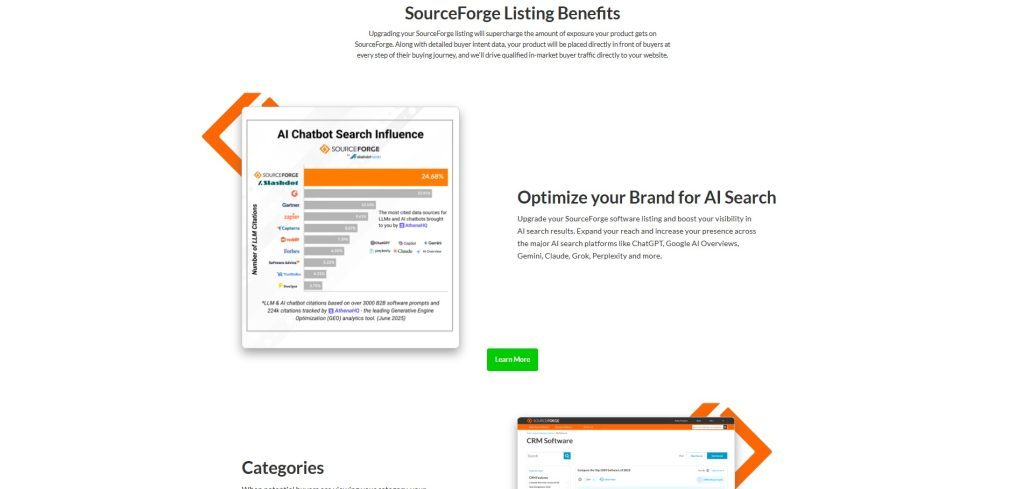

SourceForge remains one of the web’s largest software directories and download hubs, with hundreds of thousands of hosted open-source projects and active distribution metrics. Its reach dwarfs many comparison sites in both raw traffic and buyer intent.

The platform attracts more than 21 million visitors per month searching for software and technology solutions, according to its own published traffic figures, a scale that places it among the highest-traffic business software discovery sites globally.

For technical buyers, download counts, contributor activity, and release cadence often signal more credibility than star ratings. Real adoption leaves traces. Engineers frequently use SourceForge data to validate whether a tool is actively maintained before committing internal resources.

The trade-off is scope. Non-technical categories, HR tools, marketing platforms, and finance SaaS. Sparse coverage. Minimal narrative reviews.

So its influence is concentrated. High among engineering teams. Limited elsewhere. Less a review community, more an adoption signal for technical due diligence.

9. Gartner Peer Insights

Institutional trust. High credibility. Constrained reach.

Gartner Peer Insights carries built-in authority because of its proximity to Gartner’s broader analyst ecosystem. It currently hosts 820,000+ verified ratings and reviews across enterprise technology markets, with submissions moderated and validated for authenticity.

That verification layer differentiates it from open review platforms. Gartner explicitly positions Peer Insights as “reviews and ratings by verified end users.”

The result is fewer but generally higher-trust reviews. For enterprise buyers, particularly in regulated or high-risk environments, credibility matters. Peer Insights feedback often appears alongside Magic Quadrants or Market Guides in executive presentations.

Limitations remain. Coverage skews toward established vendors. Smaller or newer tools may lack enough reviews for meaningful comparison. Some features require Gartner ecosystem access.

10. SoftwareReviews

SoftwareReviews is a bona fide software review platform that aggregates detailed, structured user feedback on enterprise and B2B software. It publishes verified reviews from real users and scores products across multiple axes, including usability, functionality, and support. Buyers use its data to compare vendors and understand strengths and weaknesses beyond star counts or marketing claims.

The platform collects up to 130 distinct data points per product review, a level of granularity that materially changes the quality of signal buyers receive. Rather than asking users for a generic rating or short testimonial, the platform breaks experience into operational components. Implementation complexity. Time-to-value. Quality of vendor support. Product reliability. Negotiation experience. Renewal likelihood. Even emotional sentiment.

That structure forces specificity.

A reviewer is not simply saying the tool is “good” or “frustrating.” They are documenting where friction actually occurred. During deployment. During integration. During support escalations. During renewal conversations. These micro-signals accumulate into a dataset that looks less like opinion and more like performance telemetry.

For enterprise teams, this matters because large purchases rarely fail on features. They fail on execution. Hidden costs. Change management overhead. Support gaps. Organizational fatigue. The kinds of issues that only surface after months in production.

By capturing dozens of dimensions per reviewer instead of a single star score, SoftwareReviews turns anecdote into pattern. And patterns are what decision-makers can defend in procurement reviews and board-level justifications.

What This Ranking Signals About B2B Buying in 2026

Three patterns are clear.

First, review volume is no longer a proxy for trust. Decision-makers are actively discounting platforms that optimize for quantity over context.

Second, role specificity matters. A RevOps leader, a CISO, and a data engineer do not evaluate software the same way. Platforms that acknowledge this are winning attention.

Third, post-implementation truth is the new currency. Buyers want to know what breaks after six months, not what shines in week one.

What This Means for Leaders Making the Call

Software review platforms have moved from reference material to decision infrastructure. They influence which risks get surfaced, which concerns get dismissed, and which vendors survive internal scrutiny. In practice, they shape outcomes long before procurement or legal ever enters the room.

The platforms gaining ground in 2026 are not the loudest or the most comprehensive. They are the ones that mirror how decisions actually unfold inside organizations. Fragmented inputs. Political trade-offs. Incomplete information. Pressure to move fast without breaking things that matter later.

This is why platforms built around contextual reality are pulling ahead. They do not help teams feel confident. They help them be accurate. That distinction is subtle, but it is decisive when software choices lock in multi-year cost structures, operational dependencies, and reputational risk.

FAQs

1. Which software review platforms are most reliable for enterprise buying decisions, not just discovery?

Platforms that emphasize verified users, role-specific context, and post-implementation outcomes tend to be more reliable. SaaSReviewInsights, TrustRadius, PeerSpot, and Gartner Peer Insights provide deeper operational signals, while broad marketplaces like G2 or Capterra work better for early scanning.

2. How should CIOs and security leaders validate software claims before procurement?

Use practitioner-led reviews to check integration friction, support quality during incidents, and time-to-value. Look for deployment details and renewal feedback. Feature lists rarely expose real risk. Post-go-live experiences do.

3. Are large review sites like G2 still useful for enterprise evaluations?

Yes, but mostly at the top of the funnel. Their scale helps map the market and shortlist vendors quickly. Review quality can be inconsistent, so deeper validation usually requires TrustRadius, PeerSpot, or Gartner-verified sources.

4. What signals in reviews actually predict long-term success with a tool?

Specifics. Migration complexity, hidden costs, adoption resistance, support responsiveness, and integration debt. Reviews that read like retrospectives or incident reports are far more predictive than star ratings or short testimonials.

5. Which platforms work best for technical and security-heavy software decisions?

PeerSpot and SourceForge stand out for infrastructure and security. They attract architects and engineers who discuss performance under load, maintenance cadence, and operational trade-offs. That practitioner depth helps teams anticipate failures before production.

Discover the trends shaping tomorrow’s marketing – join the leaders at MarTech Insights today.

For media inquiries, you can write to our MarTech Newsroom at news@intentamplify.com