When G2 buys Gartner’s software assets, it rarely signals a routine portfolio shuffle. This week’s announcement that G2 will acquire three of Gartner’s most established software discovery platforms. Capterra, Software Advice, and GetApp. Marks a quiet but meaningful shift in the Martech landscape.

This isn’t just another deal. It’s a structural moment that reshapes how B2B technology is discovered, evaluated, and bought. The implications touch marketing democratisation, AI-driven decisioning, and every vendor’s demand funnel.

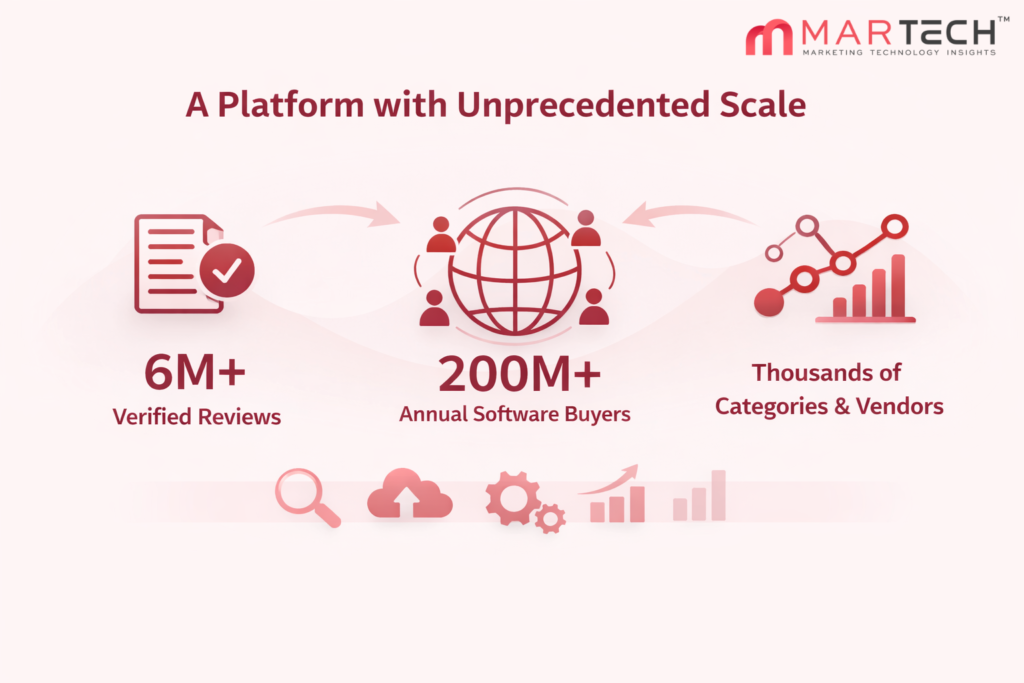

A Platform with Unprecedented Scale

For marketing leaders who’ve struggled with fragmented buyer signals, this consolidation offers simplicity. With the addition of Capterra, GetApp, and Software Advice, G2 brings together what were once disparate islands of review data into one aggregated universe. Individually, these properties influenced vast swaths of software buying cycles; collectively, they create the largest corpus of peer insights in B2B.

G2’s own numbers suggest this newly combined platform will encompass roughly 6 million verified reviews and reach 200+ million annual global buyers, spanning thousands of software categories and tens of thousands of vendors. For context: before the deal, G2 alone was used by millions of professionals across the Fortune 500 to refine technology decisions.

“This acquisition represents a transformational moment for G2 and, more importantly, the global B2B software industry,” said Godard Abel, CEO and co-founder of G2. “By integrating the verified reviews, insights, and audiences from Capterra, Software Advice, and GetApp, we’re building the trusted data foundation for buyers and sellers of software for the age of AI.”

That scale isn’t trivial. It becomes a de facto dataset for evaluating software performance, buyer intent, and category momentum. For a CMO assessing Martech ROI, the newly unified review corpus turns anecdote into trendline. For CISOs tasked with secure platform selection, it compresses weeks of research into a single source of truth.

From Fragmentation to Unified Decision Signals

Before this deal, buyers and vendors coped with noise. Different review engines surfaced different signals; each platform had its own taxonomy, intent modeling, and visibility rules. The result: competing narratives about the same software. That’s not just inconvenient, it’s costly. Buyers waste cycles reconciling contradictory reviews. Vendors toil to optimise listings across multiple ecosystems.

For revenue teams already feeding third-party signals into CRM systems, this consolidation matters. A unified review and intent layer reduces guesswork in account prioritization and sharpens late-stage deal validation.

With this acquisition, G2 creates a single trust layer for software discovery, reducing cognitive overhead and accelerating buying cycles. The platform’s core proposition – verified reviews – now sits against a backdrop of massive intent signals and aligned categorisation.

For marketing leaders, this means two key shifts:

Better buyer modelling

Unified intent signals can help predict where prospects are in the decision journey with higher accuracy.

More efficient budget allocation

With data harmonised across formerly separate platforms, marketers can reduce spend on redundant channels and focus on high-value touchpoints.

AI and the Evolving MarTech Stack

The timing of this acquisition aligns with a broader industry moment: AI is no longer a novelty in Martech; it’s a core competency. CMOs and GTM leaders are prioritising platforms that do more with less – that automate signal processing and interpret buyer behaviour at scale. According to recent industry analysis, the majority of Martech investments in 2025 focused on AI insights, predictive analytics, and automation, not just execution. This acquisition dovetails with that trend.

By uniting vast review data with machine learning following the move in which G2 buys Gartner’s software assets, the company is positioning itself to power AI-driven discovery that goes beyond simple recommendations. The goal is not just to suggest software, but to explain why a product matters to a specific buyer persona.

However, there’s a tension here. AI models are just as good as the data that feeds them. Even with millions of reviews, there’s potential bias in who writes reviews and what gets surfaced. Not every buyer is a frequent reviewer; certain segments may be over-represented. Leaders should treat AI recommendations as one input among many, not the sole source.

Early signals from G2 executives suggest the integration will push AI-powered recommendations that go beyond keyword match to contextual fit for buyer problems, not just product features.

“By combining our complementary global audiences and datasets, we are building a future-ready foundation for the entire software ecosystem,” shared Abel, highlighting how the expanded platform will power smarter, faster purchasing decisions with unified review and intent data — a move that directly impacts Martech teams’ ability to interpret buyer signals and optimise investment.

This move also aligns with a broader push toward Martech consolidation. Enterprises are increasingly favoring fewer platforms with deeper intelligence layers over sprawling stacks that generate fragmented insights.

Vendor Impact: Market Visibility and Competition

For vendors, being part of a unified marketplace changes the visibility game. Historically, discipline in SEO, category optimisation, and cross-platform presence were table stakes. Now, with one dominant ecosystem, ranking signals and placement criteria could consolidate under G2’s logic. That gives vendors a central optimisation problem – but also reduces cost and complexity. One strategy aligns their presence across formerly separate silos.

There’s also a potential downside: consolidation reduces competition among review platforms. That may slow innovation in how reviews are collected or surfaced. Marketing leaders should watch how standards evolve and push for transparency in algorithmic ranking and intent scoring.

Trade-offs and Strategic Considerations

No deal of this size is without trade-offs. Consolidation creates efficiency, but it also centralises power. G2’s market position will make it a gatekeeper for buyer perception. That raises questions about neutrality over time. Will vendors with deeper pockets gain disproportionate amplification? Will small categories get equal representation?

Leaders ought to treat this new platform as a strategic asset, not a single source of truth. Integrate its signals into broader research frameworks. Combine G2 insights with first-party data, custom surveys, and direct user feedback to get a complete picture.

Expanded Data Access: Real Consequences for the Ecosystem

One under-discussed impact of this acquisition is how it changes the data surface available to partners, investors, and consultants. By absorbing Capterra, Software Advice, and GetApp, G2 isn’t just expanding reach. It’s consolidating multiple buyer-intent, review, and category-level datasets that were previously siloed.

For technology partners and platform integrators, this creates room for richer integrations and sharper targeting models. More granular signals across SMB, mid-market, and enterprise segments mean campaigns can be tuned with greater precision, not just volume.

Consultants and investors benefit differently. Access to a broader, verified dataset strengthens market sizing, category health analysis, and growth forecasting. In practice, this reduces reliance on anecdotal customer interviews and patchwork research. Strategy becomes more data-backed, especially in crowded Martech and cybersecurity categories where perception shifts quickly.

After closing the deal, the combined entity will provide about 6 million verified customer reviews and reach more than 200 million annual software buyers globally, giving partners, consultants, and investors access to one of the largest unified B2B review and intent datasets in the industry.

A Defining Moment for Martech Leaders

When G2 buys Gartner’s software assets, including Capterra, Software Advice, and GetApp, the impact goes well beyond scale. The move represents a re-architecture of how B2B technology is evaluated and purchased, not simply an expansion of datasets.

This shift warrants close strategic attention. It enables faster, more confident decision-making, surfaces deeper buyer intent signals, and creates a unified review foundation capable of supporting every stage of the buyer journey, from early discovery through final validation.

At scale, review platforms now function as a market-wide voice-of-customer layer. They surface perception shifts earlier than surveys or analyst reports, particularly in fast-moving SaaS categories.

With great scale comes responsibility! Interpret the data through organisational context. Challenge assumptions. And use this new unified platform to inform strategy – not dictate it. Because in a world of evolving buyer expectations, agility still outperforms scale alone.

FAQs

1. Why did G2 acquire Capterra, Software Advice, and GetApp from Gartner?

G2 acquired the platforms to consolidate fragmented software discovery data, expand buyer intent intelligence, and position itself as the largest unified B2B software review and research platform.

2. How does the G2 and Gartner deal impact B2B software buyers?

Buyers gain access to a larger, more unified set of verified reviews and intent signals, reducing research time and improving confidence in complex software purchasing decisions.

3. What does this acquisition mean for Martech and SaaS vendors?

Vendors now compete within a more centralized review ecosystem, where visibility, category positioning, and buyer perception are influenced by a single dominant data platform.

4. How will partners, consultants, and investors benefit from the expanded G2 platform?

They gain access to richer, cross-market datasets that support deeper market analysis, improved targeting models, and more data-backed growth and investment strategies.

5. Are there risks associated with G2 becoming the largest B2B review platform?

Yes. Increased consolidation can reduce platform competition and concentrate influence, making transparency, governance, and data interpretation critical for enterprise decision-makers.

Discover the trends shaping tomorrow’s marketing – join us at MarTech Insights today.

For media inquiries, you can write to our MarTech Newsroom at info@intentamplify.com.