Salesforce is operating in a market where product expansion alone doesn’t deliver value. Customers already have massive stacks, martech modules stacked on CRM consoles, and dashboards that rarely translate into coordinated action.

The personnel changes and organizational recalibrations are best understood as responses to shifting enterprise expectations for CRM and MarTech platforms and, more importantly, as a window into where execution-centric technology is now being demanded at scale.

Over the past few months, it has witnessed the exit of several senior leaders in short succession, and that matters because this isn’t typical Silicon Valley turnover. It’s happening amid a broader strategic reset.

The new question, for buyers and platform builders, is: Can technology orchestrate revenue instead of just capturing it? That question shapes why executives are moving on, why roles are being redefined, and why AI embedded at the system level is repositioning the entire stack.

Systemic Shifts Are Reshaping MarTech Priorities

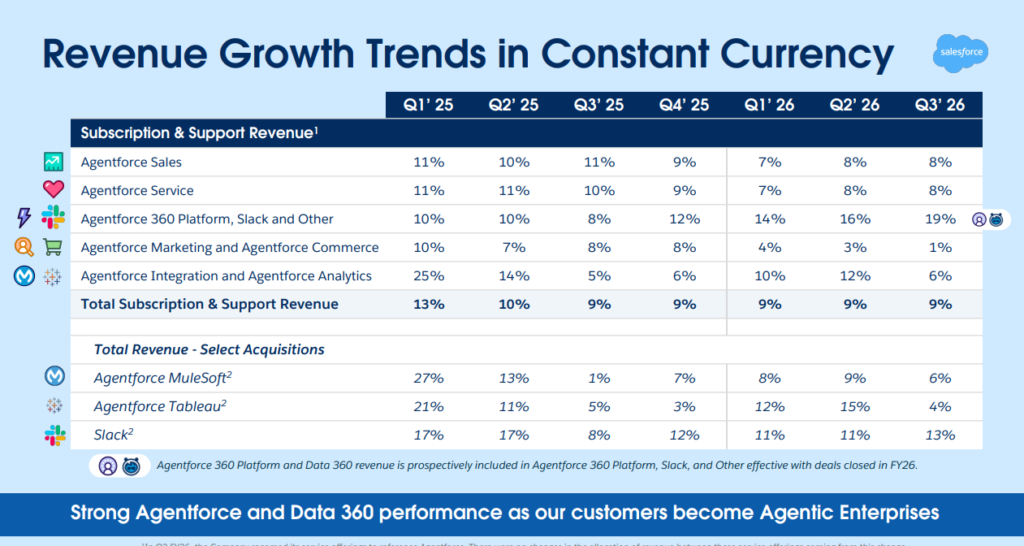

The industry has passed the tipping point where standalone dashboards and disconnected automation tools were sufficient. Adoption metrics from Salesforce’s own research show AI adoption among CIOs has surged by over 280%, but not without hesitation.

Trust in data remains a gating factor as organizations weigh the risks of autonomous workflows against the promise of scale. That hesitation reflects real trade-offs. AI’s promise isn’t abstract; systems that integrate intelligence directly into workflows can improve lead prioritization, orchestrate cross-functional handoffs, and automate repeatable tasks.

Fragmented models still produce fragmented insights. Fragmented insights produce operational drag, not execution. Recent CRM trend analyses confirm that the operational backbone of revenue is becoming the metric by which CRM vendors are judged, not feature sets or acquisition metrics.

Salesforce’s leadership shifts signal a company adjusting its operating model to these realities.

What Execution-First AI Demands From MarTech Platforms

Salesforce’s recent announcement of six new leaders following several high-profile departures reflects more than succession planning. It reflects prioritization of platform coherence, AI integration, data governance, and revenue-centric execution.

Look at where roles have been vacated and replaced: Agentforce, Tableau, Slack. These are not peripheral products.

They are interfaces to execution workflows. Agentforce 360, for example, is being positioned as a platform-level AI engine that not only automates tasks but connects humans, data, and agents into unified workflows, a shift from point automation to operational intelligence.

Salesforce is reprioritizing integration and intelligence over expansion and segmentation. That choice reflects broader enterprise demand, buying behavior that values fewer systems with deeper internal integration and stronger outcome accountability over a proliferation of specialized modules.

There is a contradiction in the market right now: innovation is rapid, but adoption is uneven and often stalled by poor data foundations. Salesforce customers experience this first-hand. Yes, AI modules exist. But their impact is constrained if data governance, identity resolution, and shared process definitions are weak.

These underlying limitations are exactly why the company’s internal strategy appears to be consolidating leadership around execution-centric priorities.

Execution Is the New Measure of CRM Value

Marketers, RevOps leaders, and digital strategists have had one phrase drilled into them for years: you’re drowning in data. That’s no longer the problem. The problem today is activation. Turning latent signals into coordinated action. Accurate forecasting. Predictive next-best actions. Orchestrated account approaches. Accountable revenue outcomes.

Salesforce’s statistics suggest AI can significantly correlate with revenue growth, with 83% of sales teams using AI reporting revenue growth compared to 66% without AI.

But that figure doesn’t tell the whole story. AI does not magically produce outcomes. It amplifies whatever strategy and governance already exist. Poor governance means they amplify errors. Good governance means they accelerate execution.

This is where a unified CRM and data platform matters. Salesforce customers who treat CRM as the operational backbone of revenue, with shared definitions and governance, achieve greater pipeline velocity and better coordination across teams. Fragmented stacks, no matter how AI-rich, won’t resolve that fundamental shortfall.

Partners as Strategic Execution Engines

Salesforce Partners have historically been valued for technical deployment. Increasingly, they are valued for operational enablement. As CRM platforms evolve toward execution infrastructure, partners able to deliver process design, data strategy, and cross-cloud integration are the ones thriving.

This shift has two implications:

- Partners must expand their value proposition beyond configuration to architecting revenue workflows.

- Enterprise customers must evaluate partner capability in terms of outcome delivery, not just project completion.

The market is signaling that technology alone doesn’t scale outcomes. Operational orchestration does. Salesforce’s internal talent reshuffle reflects that reality. Expertise in execution is more strategically valuable than expertise in feature deployment.

Internal Trade-offs and External Expectations

Here’s a tension that rarely gets discussed:

- Enterprise MarTech leaders want autonomy and flexibility.

- AI systems that drive execution require structure, governance, and constraint.

The more autonomous you allow an AI workflow to become, the more rigorous your data model must be. If your data definitions aren’t aligned across teams, autonomous executions can generate conflict, not coordination.

This creates an uncomfortable but unavoidable reality: The current generation of MarTech success depends as much on internal discipline as on external technology capability.

Salesforce’s internal shifts, both at the leadership and workforce level, suggest the company knows this. It’s building systems that constrain engines rather than engines that assume alignment.

Yes, that sounds paradoxical. But it’s a reality in software: unmanaged freedom produces noise; disciplined intelligence produces execution.

The Strategic Mandate for Modern MarTech Teams

It’s a strategic inflection point for all enterprise MarTech architects.

Salesforce’s executive transitions, workforce rebalancing, and strategic emphasis on AI-integrated platforms signal a future where:

- CRM is evaluated on execution outcomes, not technical specifications.

- AI is integrated at the system level and judged by results, not novelty.

- Partners are measured by their ability to orchestrate revenue workflows.

- Organizations must align data, process, and governance before they can scale marketing automation.

The platforms may continue to evolve. The narratives around features will shift. But the core demand isn’t changing: Enterprise systems must move organizations from insight to action, reliably, at scale.

Salesforce’s trajectory underscores that imperative, and challenges customers and partners to meet it. If MarTech leaders respond with superficial tool assessments, they’ll miss what’s actually happening: technology is no longer enough. Execution is.

FAQs

1. Are Salesforce’s leadership changes a risk signal or a strategy signal for enterprise customers?

Mostly strategy. Mature platforms reorganize when priorities shift from expansion to execution. Salesforce is tightening around AI, data, and workflow orchestration. That’s less about instability and more about preparing the core for operational accountability. The risk isn’t vendor churn. It’s whether customers are ready to operationalize what the platform can now do.

2. Is CRM still a system of record, or is it becoming something else entirely?

It’s becoming revenue infrastructure. Systems of record document activity. Infrastructure drives action. Modern CRM is expected to route leads, prioritize accounts, trigger plays, automate service, and inform forecasts in real time. If your CRM isn’t influencing decisions daily, it’s underutilized. And probably overbought.

3. Should enterprises consolidate on Salesforce or keep a best-of-breed MarTech stack?

Depends on your operating discipline. Best-of-breed gives flexibility. It also creates integration debt and data inconsistency. Consolidation reduces tool sprawl and improves signal quality, but forces process standardization. Most large enterprises underestimate the governance work required either way. The deciding factor isn’t features. It’s your ability to manage complexity.

4. How should Salesforce partners evolve to stay relevant in this AI-led phase?

Configuration work is commoditized. Execution design isn’t. Partners that only “implement” will get squeezed on price. The ones who design revenue workflows, unify data models, and own measurable outcomes will stay strategic. Boards don’t fund deployments anymore. They fund performance improvement.

5. What should RevOps and MarTech leaders measure to justify platform investments today?

Not adoption, licenses, or dashboards. Look at pipeline velocity, conversion rates, forecast accuracy, and cost of acquisition. If the stack doesn’t move those numbers, it’s overhead. Technology is now judged like any other capital investment. It either improves revenue efficiency or it doesn’t earn its keep.

Discover the trends shaping tomorrow’s marketing – join us at MarTech Insights today.

For media inquiries, you can write to our MarTech Newsroom at info@intentamplify.com.